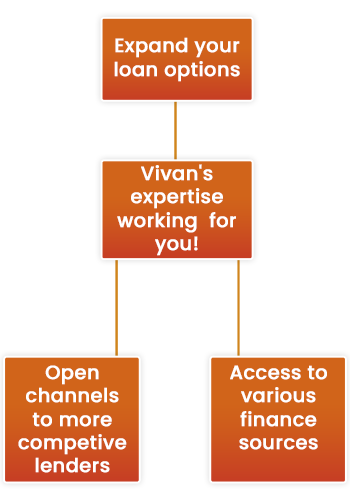

As a loan consultant, we work for YOU and only in YOUR best interests. Vivan is not an “exclusive partner” to any bank or NBFC so our only focus is sourcing YOU the best loan offers at the best interest rates so YOU can achieve YOUR financial goals.

Vivan’s fund raising support solutionsare aimed at helping both business and individuals access the right lending products available in the market. Whether you are looking for raising loans for your business or for your home purchase, Vivan’s team of dedicated specialists help you to access loans from best of lenders matching your credit profile. Our team will review a wide range of options to help you get the solution you’re looking for.

When you interact with our team at Vivan, we will work with you in order to determine your individual or entity’s financial goals and to understand what’s important to you in a loan. Whether you are looking for better rates, better customer service or longer tenor, we are here to help. There are a wide range ofloan products available and our finance consultants will recommend one that’s right for you depending on your needs andnot the lender.

Corporate/ SME Loans

Secured Business Loan :

A Secured Business Loan is provided for a fixed period of time, within which you need to pay back the loan with agreed interest to reclaim your pledged asset. Because the loan is backed by collateral, the lenders tend to charge lower interest rates and provide the loan for a longer period of time in comparisonwith other business loan products.

At Vivan Business Consultants, we understand every business is different and so is their loan requirement. Our structured approach to each and every loan proposal ensures that your requirement is pitched with the right lender, to ensure a fast, hassle-free loan without you having to do anything.Every lender has criteria on who they lend to, how much they can lend, documentation requirements and time frame. At Vivan Business Consultants, we identify the suitable bank or NBFC that can provide to bring you just the right loan. We understand and evaluate your business and capital requirements before matching you to the right lender. Our experts will work on your loan proposalto keep the fund raising stress away, so that you can focus on your business.

We help you to obtain loans that suit your requirements, and offer to arrange various products such as:

Unsecured Business Loan :

Unsecured Business Loans are loans sought by small businesses tocommence or improve their business withoutany asset security. Given that these loans carry high risk for lenders, the lending rates are very high and each lender has their own assessment criteria.

When you’re looking for a business loan, time is of the essence. Thus, youneed a loan consultant who can work with you and believes in your business objectives and deliverables andnot just your credit score. Vivan’s experienced team ofsmart consultants can connect small business owners like yourself to lenders willing to loan you money.With tie-ups with all leading banks and NBFCs, our team of experts can help you with choosing the right institution also helping you with the paperwork and following up with the lenders for disbursement.

Equipment /Machinery Finance and Operating Lease

All kinds of equipment / machinery that enable production or functioning of a service facility are must-have assets for business enterprises of any size. Businesses need financing in order to purchase equipment to transform their production processes, service facilities and make them more efficient. Equipment or machinery loans can help preserve cash flow while also helping to generate new income with a new asset.

We can also help with operating lease option. We will help you in optimizing your technology and infrastructure investment including acquisition planning and other end-of-lease services.Leasing is suitable for financing most investments in productive equipment and is available to a broad range of business and other organizations, such as hospitals, educational institutions, associations and government agencies.

Any asset, plant or equipment that can help generate income for your business may be able to be financed, and can include: